Hess Midstream (NYSE: HESM) operates oil and gas pipelines and terminals.

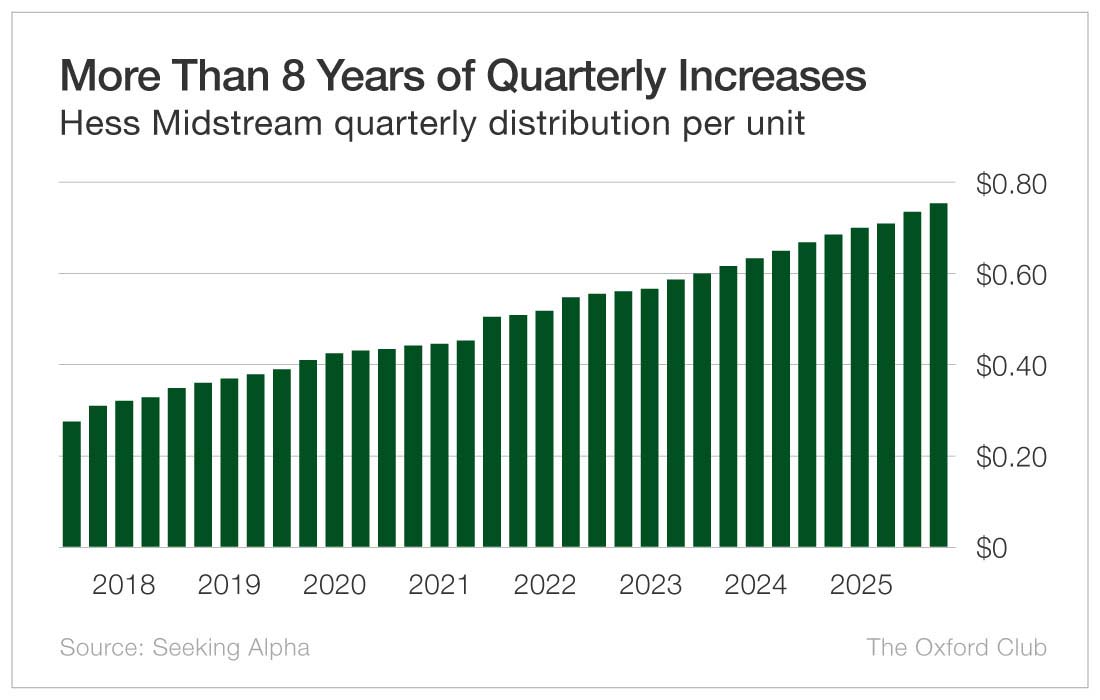

What’s particularly impressive about the company is not only its 8.7% distribution yield, but that it has raised its payout for 33 straight quarters, a span of more than eight years. (Partnerships’ dividends are called distributions, and their shares are called units.)

Can that streak continue?

Though it’s a partnership, Hess Midstream reports its results in terms of free cash flow.

In 2024, free cash flow dipped from $642.9 million to $634.2 million. The Safety Net model hates declining cash flow, even in tiny increments. A lower cash flow number results in a penalty.

Fortunately for investors, that is the only penalty when it comes to cash flow. In 2025, free cash flow is forecast to have risen to nearly $765 million, and it’s expected to climb to $799 million in 2026.

The payout ratio is low. In 2024, the company paid out just 37% of its free cash flow in distributions. In 2025, I estimate distributions paid to be around $330 million, which would be 43% of free cash flow.

For partnerships, the Safety Net model will accept payout ratios of up to 100%. Hess Midstream’s payout ratio of 43% is well below that threshold. Assuming 10% distribution growth in 2026, the payout ratio would still be below 50%.

As I mentioned, Hess Midstream is all about distribution growth. It has boosted the payout every year since it began distributing cash to unitholders. The current distribution is about $0.755 per unit.

The only dent on Hess Midstream’s record is the slightly lower free cash flow in 2024. However, that figure will age out after fourth quarter 2025 results come in.

Other than that one blemish, Hess Midstream’s free cash flow is growing, it generates more than enough cash to pay the distribution, and it has grown the distribution every quarter for more than eight years.

The risk of a dividend cut is low, and after fourth quarter results are released, the company’s Safety Net grade will most likely be upgraded to an “A.”

Dividend Safety Rating: B

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.