Small-cap stocks have had a difficult time lately, but that could change as interest rates fall. Of course, even though small caps in general have faced challenges, many of them still outperformed the market, with a sizable number of them more than doubling their stock price year to date.

Let’s take a look at some of the outstanding performers in the small-cap universe. Anything could happen in the coming days as the end of the year approaches, but for now as of early December, these are some of the best-performing small caps of 2024.

Note: The stocks included on this list have market capitalizations of between $100 million and $2 billion and are traded on major exchanges.

TSS Inc. – up nearly 3,700%

TSS Inc (NASDAQ:), or Total Site Solutions, provides end-to-end technology solutions for data centers and other technology environments. The company’s integrated platform consists of modular edge services, data center services and configuration services.

TSS’s stock has exploded since mid-August, climbing as the market was undoubtedly excited to uncover a data center stock that doesn’t get much, if any, analyst coverage. Notably, the company’s revenue surged 689% year over year in the September quarter, suggesting some good reasons for this stock to soar.

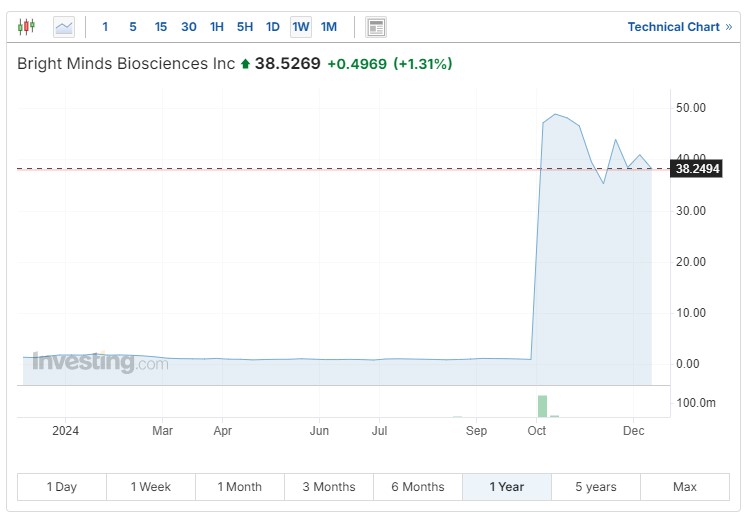

Bright Minds Biosciences – up nearly 2,600%

Bright Minds Biosciences Inc (NASDAQ:) is working on treatments for central nervous system disorders. The company currently has a treatment for rare forms of epilepsy in Phase 2 clinical trials. BMB-101 is a highly selective 5-HT2C agonist suitable for chronic dosing with the potential for pro-cognitive effects.

After spending most of the year flatlining, shares of biotech company Bright Minds Biosciences surged in late September following the closure of a $35 million non-brokered private placement. Participants included Cormorant Asset Management, RA Capital Management, Janus Henderson Investors, Vivo Capital, Schonfeld Strategic Advisors and others.

Monopar Therapeutics – up 1,400% YTD

Monopar Therapeutics Inc (NASDAQ:) is a clinical-stage biotechnology company developing next-generation, cancer-targeted radiopharmaceuticals. The company’s ALXN1840 for Wilson disease met its primary endpoint for its Phase 3 clinical trials. Monopar announced an agreement with Alexion (NASDAQ:) and AstraZeneca (NASDAQ:) for its late-stage Wilson disease drug candidate in October.

The company’s other treatments are in the earlier stages, with MNPR-101 being the furthest along. The Phase 1 trial is active and recruiting participants. MNPR-101 targets advanced solid tumors.

Monopar Therapeutics stock has had an interesting year. The shares popped in mid-to-late February before entering a range-bound period until October, when they surged overnight after the Alexion and AstraZeneca announcement before plunging and then beginning an up-and-to-the-right march through early December.

Sezzle – up nearly 1,100%+ YTD

On the verge of pressing beyond small-cap status, buy-now-pay-later company Sezzle Inc (NASDAQ:) allows consumers to purchase what they need or want now and then pay in four interest-free installments over six weeks. The company also lets consumers make monthly installment payments on larger purchases over three to 48 months.

Sezzle stock climbed gradually throughout most of the year until early November, when it surged from around $205 to approach $370 a share. The big gap up came on the heels of the company’s earnings report, in which it beat earnings-per-share estimates by over 200%, coming in at $2.92 per share versus the 89 cents that had been expected. Revenue also surprised to the upside, at $69.7 million versus the $52.6 million that analysts had been looking for.

Dave – up 900%+

Digital banking service Dave Inc (NASDAQ:) offers a mobile app that focuses on cash advances. Thus far, the company states that it has helped over 6 million members take over 97 million cash advances.

Dave’s proprietary AI underwriting model analyzes members’ cash flow rather than credit scores to determine their ExtraCash advance eligibility every time they require extra cash. CashAI considers over 180 data points, including income, irregular employment, bank balance, spending patterns and history with the platform.

Shares of Dave have gradually appreciated throughout the year until they surged in early November.

Honorable mentions

I also wanted to mention a couple of other interesting small-cap picks that have skyrocketed this year, although their market caps are smaller than my self-imposed $100 million floor.

Synergy CHC Corp (NASDAQ:) has soared more than 4,400% in 2024. The consumer health company markets and distributes consumer products via a variety of distribution channels. Synergy’s brands include Focus Factor supplements, weight loss brand Flat Tummy, and hand care brand Hand MD.

Meanwhile, Nexalin Technology Inc (NASDAQ:) is up 675% after significant drama in its stock price that saw multiple surges and plummets. The company offers a treatment for anxiety and insomnia using a non-invasive, stimulating waveform, delivering its service in the comfort of the patient’s home.

Why small caps could outperform going forward

There’s been plenty of talk about small caps coming back as interest rates fall. In fact, small caps have outperformed large caps at different times in the second half of this year. Additionally, the roared to a new record high at the beginning of December after President-Elect Donald Trump nominated Scott Bessent as his pick for secretary of the Treasury.

One of the great benefits of small caps is the potential for sizable returns, but with the possibility of great returns often comes significant risk. This is evident in the sizable rises and falls in some of the stock prices above, even though they’re still up significantly for the year through early December.

History tells us that small caps typically outperform their larger counterparts when the economy is recovering, and interest rates are falling as inflation declines. Of course, investors are always advised to do their own due diligence before investing in any stock, idea or theme.